Getting Started

Payment tokenization requires issuer effort for the legal, procedural and technical aspects of such program enablement.

MeaWallet with the Mea Token Platform is capable to support the issuer on most of the steps during the payment tokenization enablement program and provides post-implementation service.

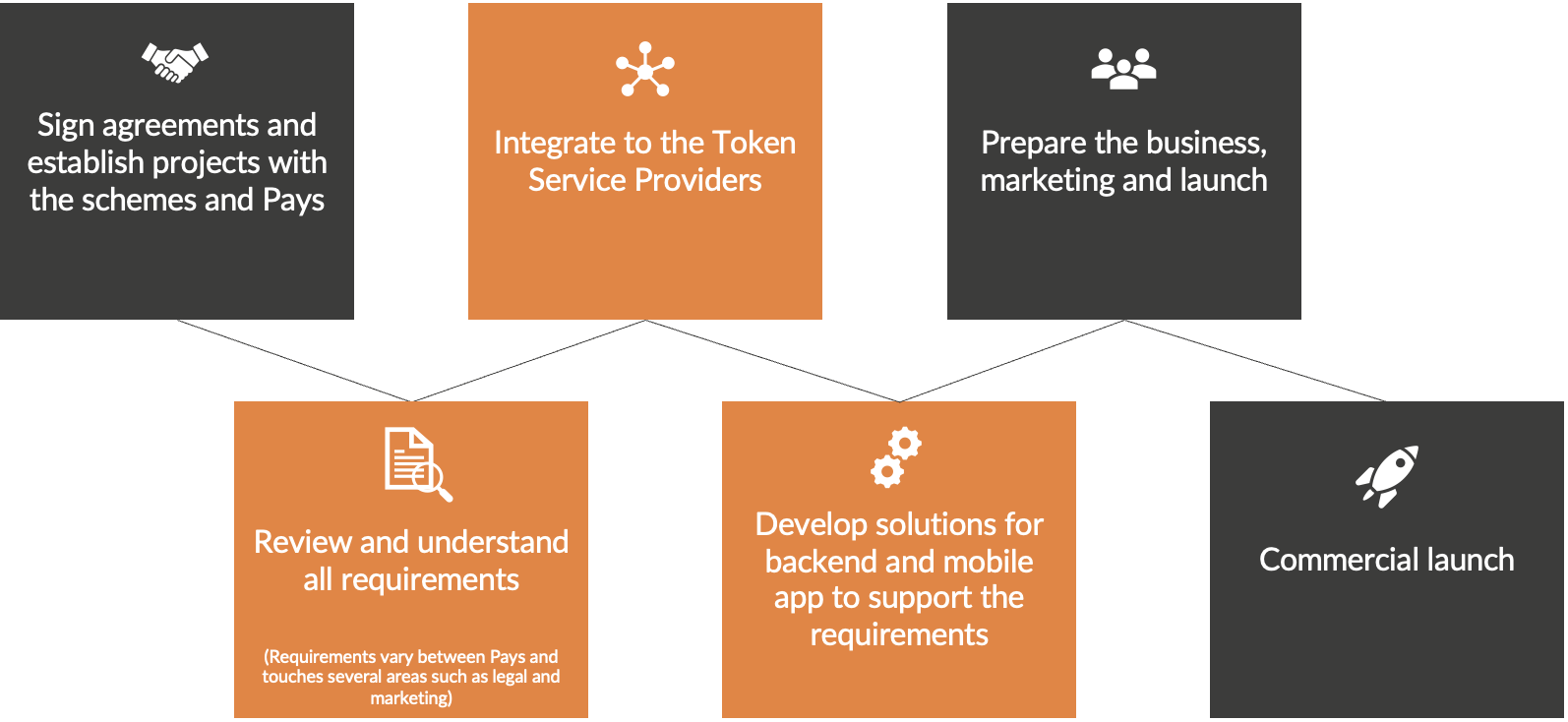

The items below outline the critical aspects of the end-to-end process for payment tokenization enablement. MeaWallet with the Mea Token Platform, expertise and professional services can become the reliable supplier and partner in the selected aspects highlighted with orange color.

Review and understand all requirements

MeaWallet has been working with the payment tokenization since the company inception in 2013 and has proven track as one of the worldwide leaders in digital payments solutions with more than 100 satisfied customers. Outcoming of that, MeaWallet expertise and professional services gives the best opportunities and support for issuers to understand all complex requirements and their implementation within the payment tokenization enablement program.

Integrate to the Token Service Providers

Mea Token Platform is integrated with the multiple token service providers where MDES as Mastercard Digital Enablement Service and VTS as Visa Token Service among them as most demanded ones. MeaWallet is recognized as the Mastercard Platinum Engage Partner while Mea Token Platform is a pre-certified Visa Ready solution.

Develop solutions for backend and mobile app to support the requirements

Mea Token Platform consolidates integration with the multiple token service providers into the single API reducing the complexity for issuers and providing optional on-behalf services to make integration even more easier.

Issuer onboarding process will be managed and assisted by an assigned and dedicated onboarding engineer. Onboarding process includes the integration testing for issuers where involvement of the payment network is not mandatory because of token service provider simulators developed by MeaWallet. This allows issuers to be ready with the integration even before the certification and attended testing with payment networks starts. Integration properly tested on time significantly optimizes the costs and effort for a payment tokenization enablement program.

MeaWallet value-added services such as Mea Push Provisioning SDK, Mea Token Control SDK minimise issuer effort for development of mandatory or advanced payment tokenization features and functionality into their mobile application.